Sign Up With Wyoming Federal Credit Union: Secure and Member-Focused Banking

Sign Up With Wyoming Federal Credit Union: Secure and Member-Focused Banking

Blog Article

Unlock Exclusive Perks With a Federal Cooperative Credit Union

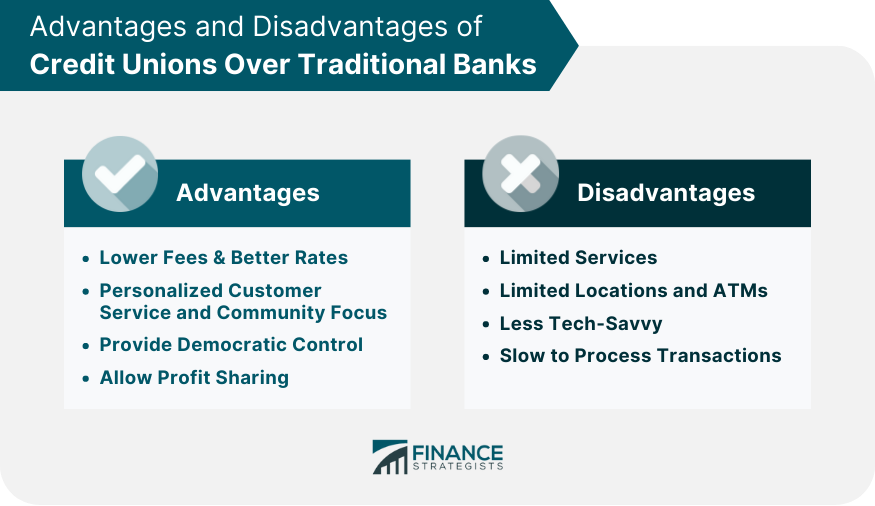

Federal Cooperative credit union provide a host of special advantages that can substantially influence your economic health. From boosted savings and examining accounts to lower passion rates on car loans and customized financial preparation solutions, the benefits are customized to assist you conserve cash and attain your financial objectives much more efficiently. There's even more to these benefits than just monetary rewards; they can additionally give a feeling of safety and security and area that goes beyond typical banking solutions. As we explore better, you'll discover exactly how these special benefits can genuinely make a distinction in your financial journey.

Subscription Qualification Standards

To become a member of a federal cooperative credit union, people have to satisfy details qualification criteria developed by the organization. These criteria differ depending upon the particular cooperative credit union, yet they usually consist of variables such as geographic location, employment in a particular industry or business, subscription in a particular company or organization, or household partnerships to present participants. Federal lending institution are member-owned monetary cooperatives, so eligibility requirements remain in place to guarantee that people who join share an usual bond or organization.

Boosted Cost Savings and Inspecting Accounts

With improved financial savings and examining accounts, federal credit unions use members superior monetary products created to optimize their money management techniques. Additionally, government credit history unions normally give online and mobile financial solutions that make it hassle-free for members to monitor their accounts, transfer funds, and pay expenses anytime, anywhere. By utilizing these improved financial savings and examining accounts, participants can optimize their financial savings possible and successfully manage their everyday funds.

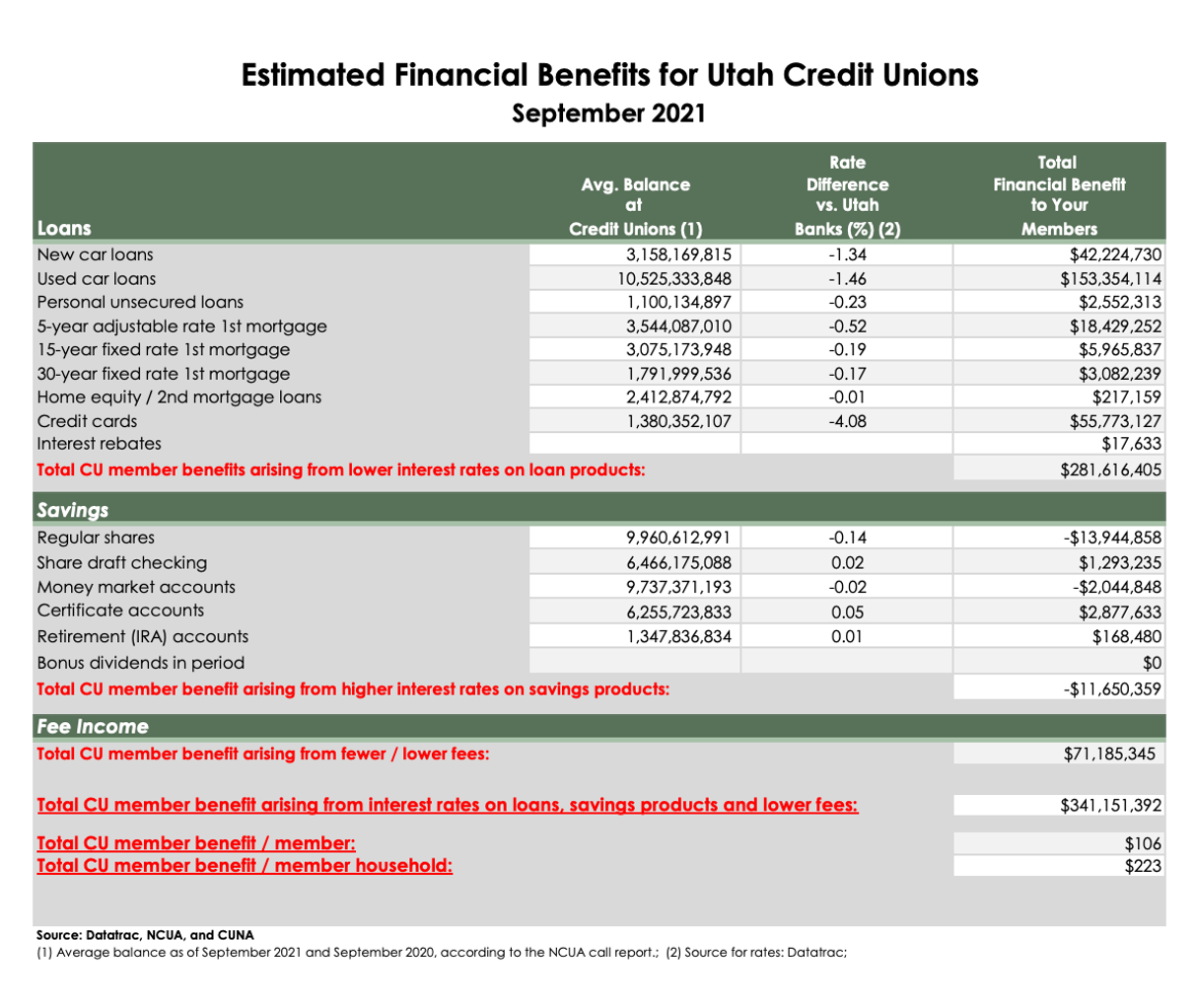

Reduced Rate Of Interest on Lendings

Federal credit unions supply members with the advantage of reduced interest rates on car loans, allowing them to obtain money at more budget-friendly terms contrasted to various other economic establishments. Whether participants require a loan for a car, home, or individual expenditures, accessing funds with a government credit union can lead to a lot more desirable repayment terms.

Personalized Financial Preparation Solutions

Offered the emphasis on enhancing members' monetary well-being through lower rate of interest rates on fundings, government credit score unions additionally offer tailored financial planning services to help people in achieving their lasting economic goals. By examining income, expenses, possessions, and liabilities, government credit score union monetary organizers can assist members create an extensive monetary roadmap.

Moreover, the individualized monetary planning solutions used by government credit scores unions usually come at a reduced cost compared to personal financial advisors, making them much more accessible to a larger range of people. Members can take advantage of specialist support and know-how without sustaining high costs, aligning with the cooperative credit union philosophy of focusing on members' financial well-being. In general, these solutions goal to encourage members to make enlightened economic decisions, construct wealth, and protect their economic futures.

Access to Exclusive Participant Discounts

Members useful source of federal lending institution take pleasure in unique accessibility to a variety of participant price cuts on numerous products and solutions. Cheyenne Federal Credit Union. These discount rates are a valuable perk that can help participants save money on special acquisitions and daily expenses. Federal credit scores unions commonly companion with stores, provider, and various other organizations to supply discounts exclusively to their participants

Members can take advantage of discount rates on a variety of items, consisting of electronics, apparel, traveling bundles, and more. Furthermore, solutions such as car services, resort reservations, and amusement tickets might additionally be offered at discounted rates for lending institution members. These special discounts can make a considerable difference in participants' spending plans, allowing them to delight in financial savings on both important items and high-ends.

Verdict

To conclude, joining a Federal Credit rating Union provides various advantages, including enhanced cost savings and inspecting accounts, reduced rate of interest on car loans, individualized economic planning solutions, and access to unique member price cuts. By ending up being a participant, people can gain from a variety of financial advantages and solutions that can help them conserve cash, prepare for the future, and reinforce their connections to the local community.

Report this page